Market Update: November 2022

The end of the winter cropping season is near and it’s not the fairy tale ending we were hoping for. Our thoughts are going out to our Victorian and NSW growers who have been devastated by the floods and excess moisture. It looks like it’s going to be a long and muddy harvest for many of you. We hope that you can get as much of your crop off, into the bin and into the bunkers/silos as you can. If we can do anything to help in any way over the next month please drop us a line, we’re here to help wherever we can. In chemical news this month we’d like to focus on summer spraying products and the main topic is glyphosate.

Glyphosate

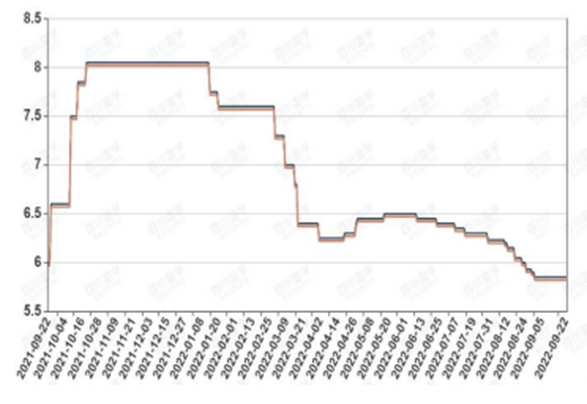

Glyphosate is slowly coming back in price. This time last year you were paying around $10L for Glyphosate 450g/L. Currently we are seeing pricing come back to under $8L settling in the high $7s. We anticipate a decrease for stock coming in for sowing, but we don’t think there’ll be much change in pricing between now and summer as that stock has already landed. Given the extremely high demand coming for summer spraying we suggest you order now for summer only and come back later for your sowing needs. See the chart below for glyphosate technical pricing over the last 12 months.

Glyphosate Technical Pricing: September 2021 – September 2022

Paraquat

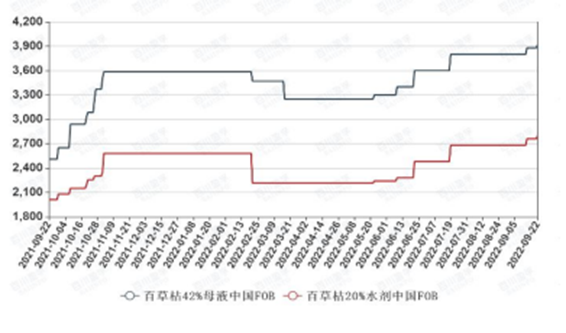

Paraquat tracks glyphosate and has come off from where it was 12 months ago but has now stabilised, with the only problem now being that supply is tight. One of the raw materials, pyridine, is tight and increasing in price and factories are not able to run at full capacity. Expect pricing to remain around the $6L mark. Keep being organised for paraquat for summer given the tightness and possibility of an increase going forward. See the chart below for Paraquat pricing over the last 12 months.

2,4-D’s – Amine 625 and Ester 680. Price has come off from last summer and is now stable. Supply is good so grab 2,4-D’s as you need them. Given the summer demand it’s likely the best deals will be earlier in the season. Please see the chart below for 2,4-D pricing over the last 12 months.

2,4-D Pricing: September 2021 – September 2022

Wetters & Oils

The biggest news here is the coming price increase of Smart 700 due to the price rise of the key ingredient soy lecithin. Smart Penetrator is also increasing in price due to raw material price increases. Order these two products early. Prices are only going one way.

Fertiliser

Markets globally remain quite bearish predominantly on the back of low demand internationally. Markets for both Urea & Phosphates have been sliding since our last update albeit the corresponding decline in the AUD/USD has negated some of these decreases when converting to Australian dollars.

Phosphates

As widely reported China has enforced export quotas for the remainder of this calendar year. Whilst more tonnes have been made available than originally thought the ‘market’ has factored the limited tonnes into the overall global supply situation. At this stage there have not been any tonnes allocated for 2023 which will require suppliers to source from alternative markets such as Russia, North Africa and the Arab Gulf which are generally more expensive and incur higher shipping costs.

No doubt these additional tonnes from China have helped prices ease, however just as quickly as they allowed exports to resume they can also stop exports. Consensus is Chinese tonnes won’t become available in the first quarter of 2023.

At the moment we believe the market will soften more in the coming weeks however there will be a point where supply concerns need to be taken into account to ensure product is available when required. We must also be mindful of the current volatility in all global markets, it will only take on supply shock as we have seen recently (global gas price, Russia/Ukraine etc) to push prices higher or reduce supply/availability.

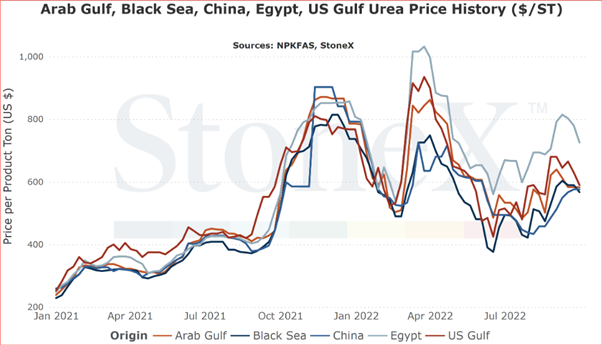

Urea

Somewhat like Phosphates, prices have been declining internationally to be back in-line with the start of 2022, but still incredibly high historically.

Urea Price History January – July 2022

Gas and Europe continues to be the major focus for Urea. Europe accounts for approximately 5% of global production or roughly 11M tons of Urea per year. Estimates put current European production rates at 30% of normal or approximately 8M tonnes of lost production. Natural gas prices have plummeted from their recent highs raising the chance that production turns on and price softens.

Summary

Given the uncertainty of the world right now we want to keep encouraging you to be organised. Please ensure you talk to your Crop Smart sales representative about your requirements, so we can work on securing winter plant requirements. The great news is supply of product across the board has increased and most prices have come back. In the next 3-6 months we expect product to flow to market easier than the last two years and at a lower cost. In caution though we do say that with the uncertainty present things can change at any time. Work closely with us and we can guarantee you will get the product you plan for on time and at the right price. Please reach out to any of us in the Crop Smart team as we’re here to help. Thanks and good luck for harvest.