Market Update: December 2022

It’s great to see some positive harvest stories coming from our network over the last month after everyone received a delayed and frustratingly slow start due to rain. In areas like the Eyre Peninsula, SA where conditions got very wet but not under water growers are reaping some of their best crops in their lifetimes. It’s a rare event when you hear this but it’s great to be able to talk to growers in their 70’s with big smiles on their faces sharing how they thought 3 and 4T wheat averages were not possible in marginal country. In the same marginal areas of the EP where canola and lentil crops average 0.50-0.7T/Ha they have yielded over 2T.

The Yorke Peninsula and Mid North of SA have been mixed to well above average – depending on how much rain you got, especially good quality early rain. The Eastern half of the SA also has mixed results. The dryer parts of the SA Mallee have yielded well above average but have been affected by late hail and army worm damage. The South East of SA has also been between average and well above average.

As we move into Victoria the summary is very mixed. Anyone along the river Murray and anyone with major creeks or waterways experienced flooding and major crop loss. Anything not under water is now starting to dry up and yielding above average but average farm yields are well down when you have parts of the farm yielding 0%. In higher rainfall areas of Yarrawonga and the Wimmera anything not waterlogged is starting to show very positive yields. Both areas had lots of low-lying areas water logged and whilst the cereals handled it well that wasn’t the same for the lentils or canola. Farmers who were able to apply the last fungicide and application of urea for the season are yielding significantly better crops than those who couldn’t. Yields are also showing that cereals have handled the wet conditions extremely well, canola just OK, and lentils certainly didn’t enjoy having “wet feet”!

The biggest frustration for many Vic and NSW growers has been the number of times getting bogged. Some of our growers have been bogged over 100 times this harvest! It looks like it’s going to be a very long and frustrating harvest for many so we hope for dry skies and a smooth run for the rest of December and January.

Summer Spraying

Moving onto crop inputs the story is quite short for summer spraying. We’ve recommended everyone to get positioned for their first summer spray but hold off purchasing for the whole knockdown season as pricing of major sprays of glyphosate and paraquat are softening. This continues to be the case due to soft demand globally. Major glyphosate producers in China met early November and all agreed to reduce capacity at factories by 30% to send a signal to the global market that they want to stabilize the price. Will this work? Time will tell.

So the summary is to ensure you’re organised for your first summer spray. It looks like demand for summer spraying product will be as high as ever but we’ve tried to prepare with solid supply of 24d, adjuvants and spikes. Please talk to the team to help you assist your procurement strategy and arrange for product to be dropped on farm.

Fertiliser

Fertiliser markets continue to throw up challenges for all involved. The wet spring has severely limited the summer cropping opportunity for the Northern markets with significant tonnages of Urea in particular carried over across the major ports which will be causing some headaches for the owners of it.

Urea

Internationally Urea continues to decline in price down significantly to a fourteen-month low, albeit still very high compared to prices that we have been accustomed to historically. General consensus is that it will soften further leading into our winter planting window.

Phosphates

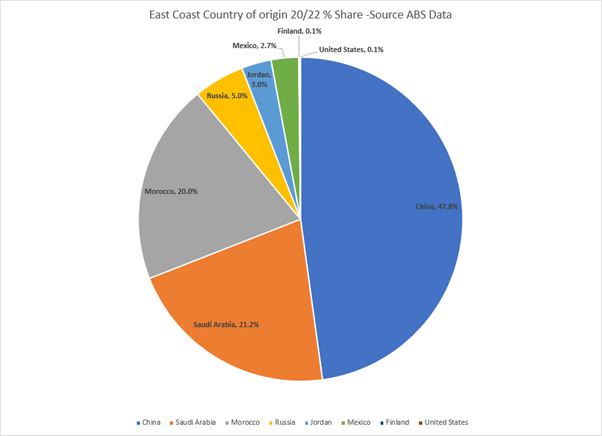

Pricing internationally has been trading sideways for the last few months. Whilst we will never see it officially in writing, the consensus is very firm that there will be no Chinese tonnes exported into Australia in Quarter 1, 2023. China has exported tonnes to Australia in the back-end of 2022 which included Compound product, MAP/DAP and SSP. The balance of Australia’s tonnes has and will need to come from the Arab Gulf or North African suppliers.

Brazil demand continues to be the major market internationally short-term as they enter planting windows for Soybeans. This will taper off from late January in the southern states, through to the biggest states into early February, and further North by the end of February. USA demand is quiet given dry conditions and carryover stock resulting in lower prices domestically, however unfortunately for Australia, it’s very rare that US tonnes will make their way here and in particular the East Coast.

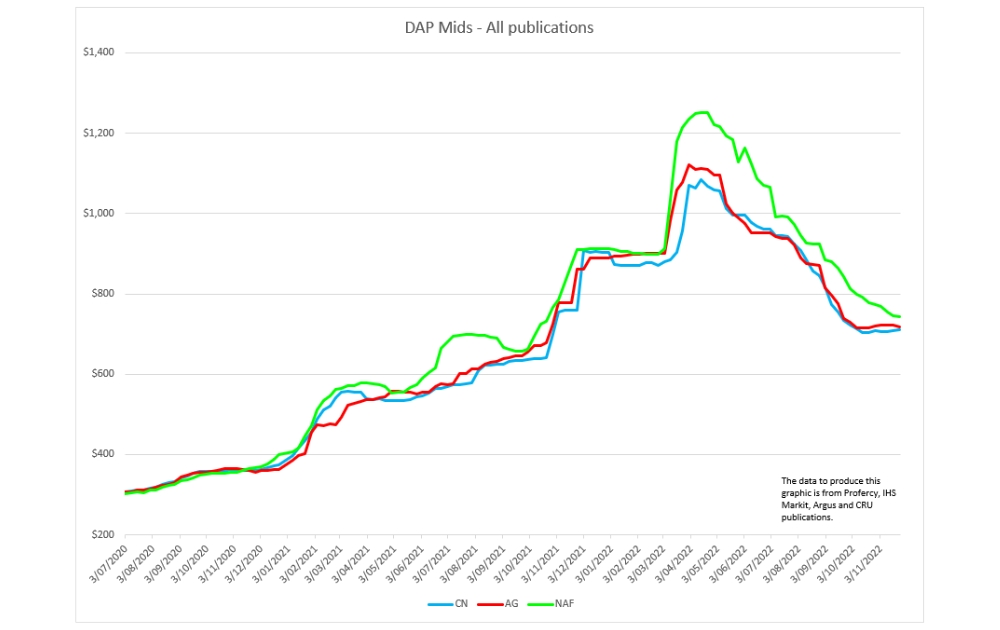

Picking the bottom of the phosphate market is next to impossible so we won’t pretend to have all the answers like some experts out there at the moment. However current pricing does appear reasonable when compared to international replacement.

DAP FOB ex China/North Africa/Arab Gulf : July 2020 – November 2022

We thank you all for your support during 2022. It certainly has been a season with a lot of twists and turns and we hope that you have a smooth run for harvest from here. Whilst January will be busier than normal we hope you can find some time to celebrate the festive season with family and friends.