Market Update August 2024

A Crucial Turning Point

The season has taken a dramatic turn, leaving much of the southern region parched and desperate for rain. Forecasts offer a glimmer of hope, but the situation remains critical. In parts of South Australia, crops are facing unprecedented delays, underscoring the need for favourable conditions to salvage average yields. After some areas of SA getting 10-20mm overnight hopefully things will start to look more positive.

Regional Crop Outlook:

South Australia: From late and dry starts in the Eyre Peninsula, Yorke Peninsula, and Mid North to below-average prospects in the Riverland and South East, the situation has been challenging.

Victoria: While summer rains offer some promise in the Mallee, the Wimmera mirrors the struggles seen in parts of SA.

New South Wales: Southern NSW stands out with more favourable rainfall, but the overall picture remains mixed.

The coming weeks will be pivotal, and all eyes are on the weather forecasts. Will they finally deliver the much-needed late-season rainfall?

Chemical Market Update:

Low demand in China coupled with robust production is keeping chemical prices down. Growers are benefiting from historically low prices for many actives. Barring unforeseen events (see below) this situation will remain stable for the foreseeable future.

Flutriafol Supply Alert:

A recent factory explosion in China has tightened the supply of raw materials for flutriafol. While product availability for Feb-April shouldn’t be significantly affected, growers planning to apply to fertiliser before Christmas should place their orders promptly.

Paraquat and Diquat Regulatory Changes:

Proposed changes by the APVMA could impact paraquat and diquat usage:

- Spray Seed (Paraquat/Diquat) to have a max rate of 800ml. Only registration is prior to crop establishment.

- Maximum rate of 800ml/ha for paraquat pre-sowing

- Maximum rate of 400ml/ha for paraquat spray topping

- Loss of all pre-harvest registrations for diquat

- No desiccation registration for paraquat

If you’re concerned about these changes we encourage you to submit your feedback to the APVMA before October 29th via the link below:

Fertiliser Update

Urea markets have been very stable over the past 6 weeks. Even with drier conditions and reduced tonnages dispatches ex Port has been challenging once again this season with all suppliers experiencing delays. Thanks to our clients and transport operators who have worked with us this year to get the tonnages out, we very much appreciate your support.

Internationally Urea markets are very quiet at the moment – at the time off writing India have released a new tender so the focus will turn to this and what flow-on impacts it will have. For us locally the season is all but done with some top-up tonnes still going out, our focus will be watching the market through to Christmas and watching for any opportunities for pre-plant applications.

What’s happening with phosphates? As communicated previously what happens in China and India ultimately determines what we see here in Australia.

India, the world’s largest phosphate buyer, has been hampered by their government’s subsidy program, which has prevented timely imports. As a result, the pace of imports has slowed, and stockpiles have dwindled to concerning levels. The last time stocks were this tight, farmers protested in the streets — a scenario the government will undoubtedly want to avoid. Therefore, it’s expected that the subsidy program will be adjusted to allow India to catch up.

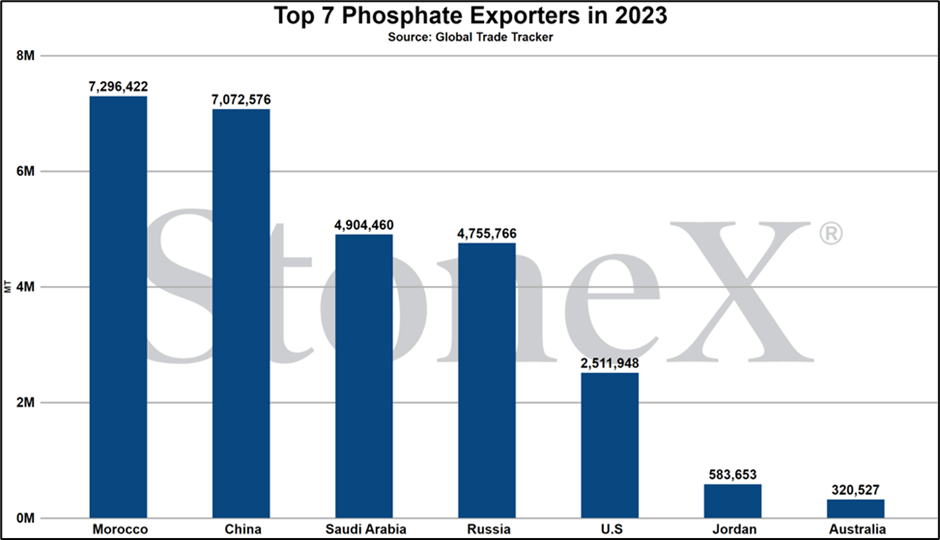

From our perspective, once India addresses the subsidy issue, they’ll likely initiate a buying spree to replenish their stockpiles. With only five major exporters globally (Morocco, China, Saudi Arabia, Russia & USA), they are likely to capitalise on the situation and at a minimum keep prices at current levels or push them higher.

We can only hope that the Chinese government doesn’t restrict exports again, as that would further exacerbate an already challenging situation.

August and September are crucial months for the cropping season. We extend our best wishes to all growers and encourage you to reach out to our team for any in-crop assistance. Let’s hope the weather cooperates and the season takes a positive turn.