Market Update June 2024

June 2024 Market Update and Smart Prepayment Opportunity

The growing season has seen a slower start than usual in many areas, with crops just beginning to show signs of life. While slightly behind schedule, we remain hopeful that consistent rainfall will soon establish healthy crop growth.

Chemical Market Update

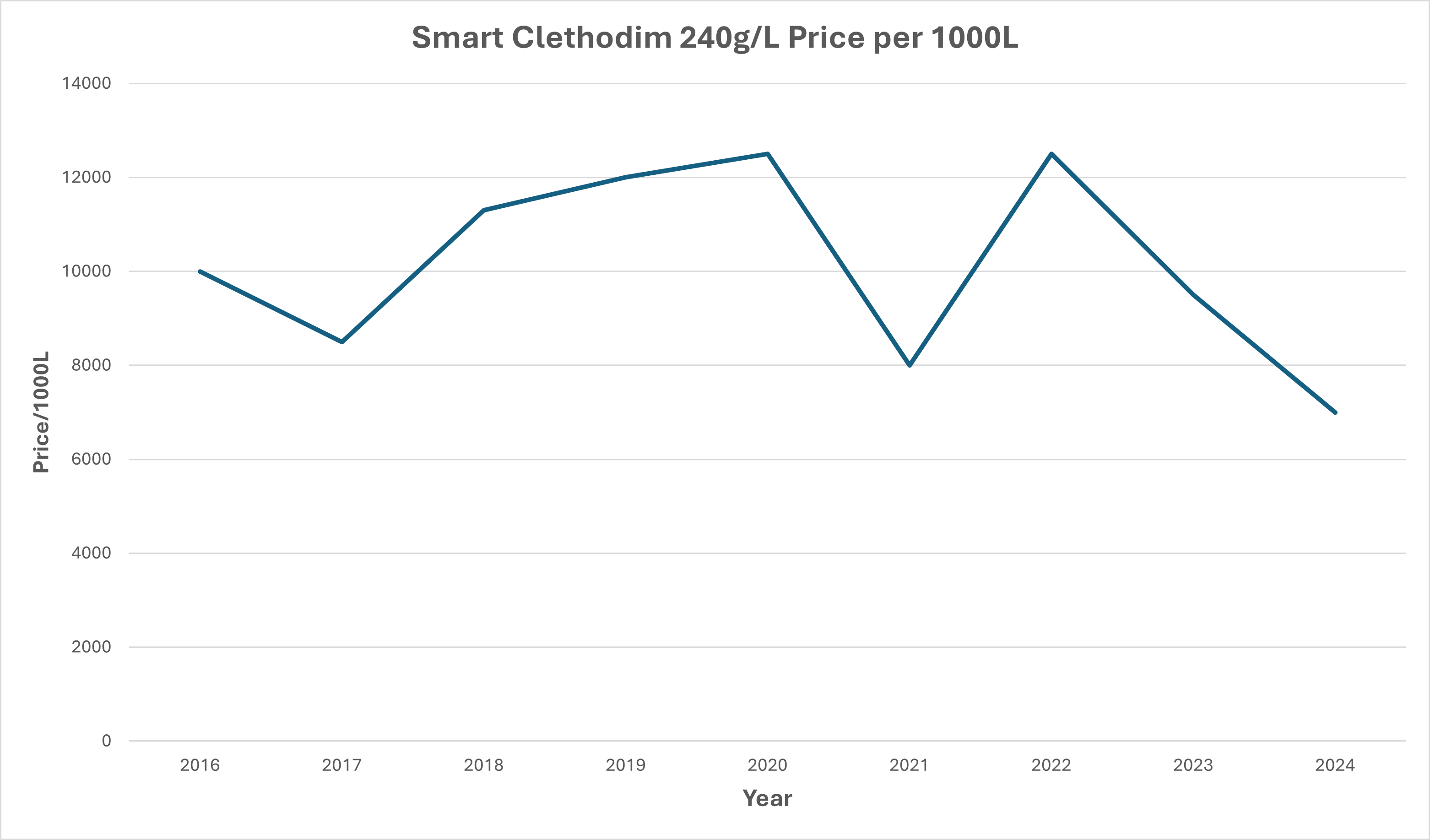

Similar to the weather patterns, the global chemical market remains relatively stable. Chinese production is at full capacity, and global demand is low, resulting in lower prices for many chemicals compared to last year. Some products, such as clethodim and certain in crop chemical and fungicides like Smart Pro Grow (Prothioconazole/Tebuconazole) and Smart Commandeer (Imazamox/Imazapyr), are at all-time low prices.

Key Questions for Consideration

The current situation raises two important questions:

- How long can these low prices last? While we cannot predict the future with certainty, the current market conditions present a unique opportunity.

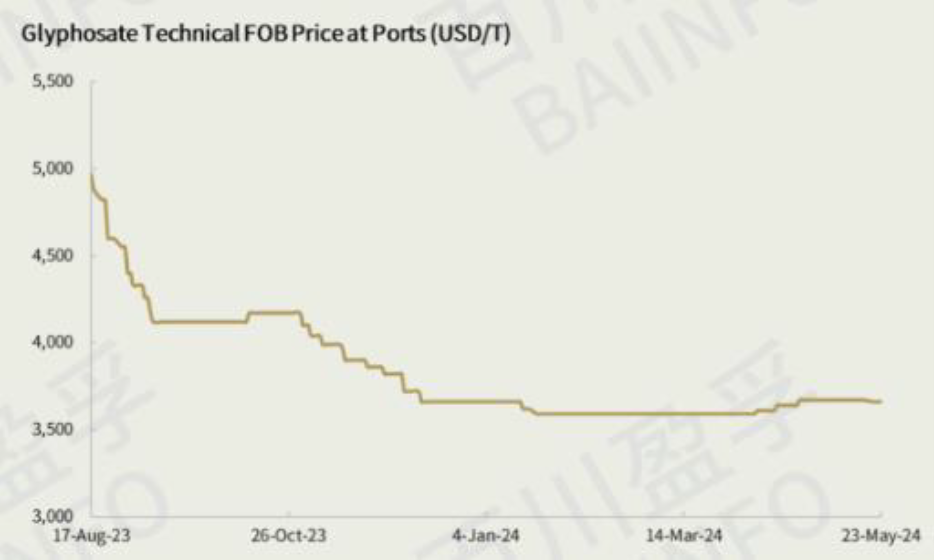

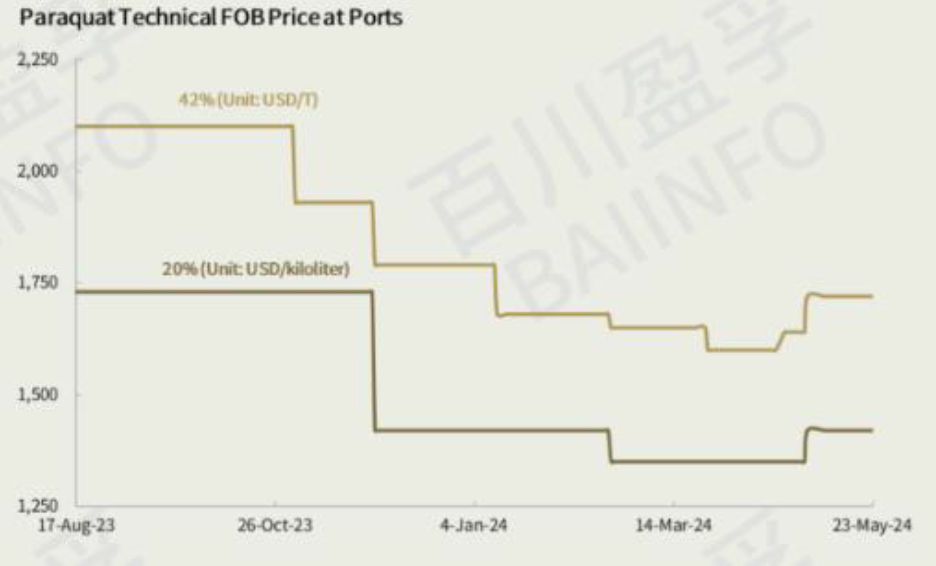

- Should you buy some to stock up? As we approach June 30, it’s worth considering stocking up on key actives like Paraquat and Glyphosate. The charts below illustrate significant price decreases in the past 12 months, similar to the buying opportunity we saw last June. Last year, the last two weeks of June was the only time glyphosate 450g/L fell below $4L.

Supply and Delivery

The chemical supply for the 2025 season is robust, and the lack of rain has ensured that most resellers have ample stock. We are actively delivering post-emergent herbicides and fungicides to many organised growers, and we encourage you to contact us if you require assistance.

Smart Prepayments

This year, we are offering an exceptional reward rate of 5.4% p.a. for growers who prepay funds into their accounts before June 30. This is the highest rate we’ve offered in years. For full details and the online application form, please visit: www.cropsmart.com.au/about-us/smartfarmer/

Fertiliser News

This time of year, as always it’s about Urea. The past month saw a flurry of activity in Urea markets with prices ex works in Australia dropping into low $600mt territory. This provided an excellent opportunity to secure tonnes for the June/July application window, albeit with limited moisture purchasing was rightfully limited.

Since that last dip in the market Urea has rallied over USD40mt (FOB Basis) primarily on gas supply issues in Egypt and the Chinese continuing to muddy the waters with exports.

In regards to Egypt, reports indicate supply has been stabilised and suppliers should return to production however short-term the damage was done (see more info here).

The China situation has been covered by us before – effectively they have become an unreliable supplier who cannot be counted upon. Exports remain non-existent still.

Domestically as you would expect supply has been OK until now, however supply for new tonnes is very limited for July dispatching – if you have requirements for July out of Southern ports you need to act sooner rather than later. Pricing has moved back up domestically to around $660mt ex works at time of writing.

We hope the rain arrives soon and the forecasted La Nina brings ample moisture. We anticipate a busy period leading up to the end of the financial year, so please don’t hesitate to contact our team if you need assistance with any of the products mentioned above or any other items in our Smart product range.